Shockwave Medical to acquire medical device company for $100M

Shockwave Medical, the California-based healthcare company known for its intravascular lithotripsy (IVL) technology, has agreed to acquire Neovasc, a medical device company with headquarters in both Canada and the United States. The deal is worth approximately $100 million, which breaks down to an upfront cash payment of $27.25 per share of Neovasc.

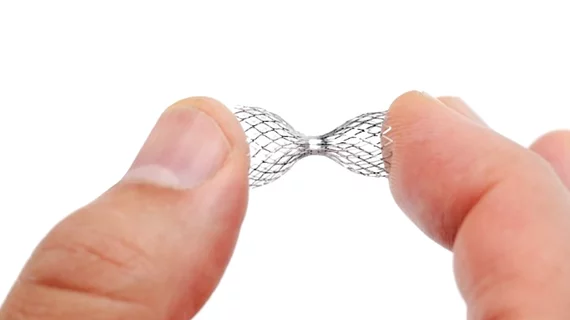

Neovasc develops solutions designed to treat various forms of advanced heart disease; its two primary targets are refractory angina and mitral valve regurgitation. One of the company’s biggest ongoing projects is the Neovasc Reducer System, which is designed to reduce symptoms associated with refractory angina by altering a patient’s blood flow. The system, which implanted using a minimally invasive procedure, has already received CE mark approval in Europe. It has not yet gained full approval from the U.S. Food and Drug Administration, but it did receive the agency’s breakthrough device designation in October 2018 and is currently being evaluated as part of the COSIRA-II clinical trial.

“Our team at Shockwave has proven that we excel at developing products and markets for large, underserved patient populations and commercializing innovative solutions for these patients,” Doug Godshall, president and CEO of Shockwave, said in a prepared statement. “We believe the Reducer is an excellent fit for Shockwave as it enables us to apply our capabilities to address another large, unmet need within cardiology—refractory angina.”

“Refractory angina is a debilitating condition without an effective therapy that impacts millions of patients,” added Gregg W. Stone, MD, principal investigator of the COSIRA-II trial and director of academic affairs for the Mount Sinai Heart Health System. “The ongoing COSIRA-II randomized trial has been designed to definitively demonstrate that the Reducer is superior to a sham control for these patients, offering the potential to change the lives of these patients who are desperate for a solution for their refractory angina.”

Additional details about Shockwave’s agreement to acquire Neovasc

- In addition to the upfront payments of $27.25 per share, Neovasc shareholders will also receive a potential deferred payment that entitles the holder to receive up to an additional $12 per share if certain milestones are met.

- The per-share terms of the acquisition represent a premium of 27% compared to the closing price of Neovasc common shares on Jan. 13.

- The deal is scheduled to be finalized in the first half of 2023.

- Neovasc’s board of directors has already unanimously approved the transaction.