Haemonetics to acquire medical device company known for its TAVR guidewires for $253M

Haemonetics Corporation, a Boston-based healthcare technology company, has agreed to acquire OpSens, a Canadian medical device company, for approximately $253 million.

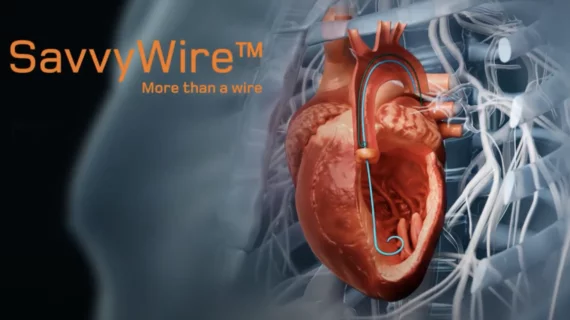

OpSens, founded in 2006, employs approximately 300 people and is known primarily for manufacturing devices used by interventional cardiologists and cardiac surgeons. For example, its SavvyWire device is a sensor-guided 3-in-1 guidewire used during transcatheter aortic valve replacement (TAVR) procedures. OpSens has said it is the first interventional device of its kind in the world. The company also manufactures the OptoWire device, a pressure guidewire designed to improve vessel assessments by recording accurate fractional flow reserve (FFR) and diastolic pressure ratio measurements.

According to Haemonetics, this deal will go a long way toward expanding its hospital portfolio, becoming “a leader in minimally invasive TAVR procedures” and increasing both short- and long-term revenue. One of the company’s specific goals is to make SavvyWire the No. 1 guidewire for TAVR procedures in the United States.

In addition, Haemonetics believes its commercial and clinical capabilities will increase patient access to OpSens devices and potentially help those devices gain regulatory approvals for new indications.

“With the acquisition of OpSens, we expand our leadership in interventional cardiology and strengthen our foundation for additional growth and diversification,” Stewart Strong, president of the global hospital division at Haemonetics, said in a prepared statement announcing the acquisition. “By leveraging OpSens' proprietary optical sensor technology, our global commercial infrastructure, and our relationships with the top U.S. hospitals performing TAVR and PCI procedures, we have a powerful opportunity to improve standards of care for more physicians and patients worldwide. We are excited to welcome OpSens' talented team and look forward to advancing our shared commitment to maximizing patient benefits and value for our customers.”

The all-cash transaction is expected to close by January 2024.

Haemonetics created a 10-slide presentation about its acquisition of OpSens. Click here to read the full document.