Getinge ending production of cardiopulmonary surgical perfusion systems

Swedish company Getinge says it is moving ahead with plans to phase out its cardiopulmonary surgical perfusion product portfolio by the end of 2025. This will free up money for expanded investment in its extracorporeal membrane oxygenation (ECMO) and intra-aortic balloon pump (IABP) offerings, although they are currently facing quality control issues.

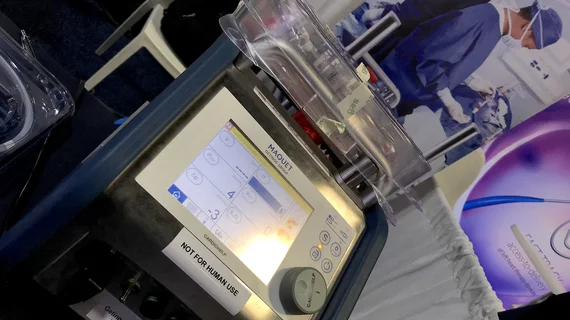

The company plans to end production of its HL 40 Heart-Lung Machine and HCU 40 HCU 40 heater-cooler unit and related disposable products.

One of the main reasons for ending production is the fact that these products were not included in the lucrative U.S. market since 2015, when Getinge signed a consent decree with the U.S. Food and Drug Administration (FDA) to temporarily suspend production of of the devices at its manufacturing site in New Hampshire because of quality production management issues. However, devices never returned to the U.S. market and the same unresolved consent decree are still causing issues with regulatory bodies.

Getinge said it is abandoning the market because of a continual decline in market share since the end of its U.S. sales. In 2018, the company said it had about 15% of this market and in 2023 this had declined to about 7%. Also, with more cardiac surgeries now being interventional, the company said prospects for future market growth is limited.

"We are proud of our legacy and the products we have, but unfortunately we have been challenged gradually over the past 10 years with a steadily decreasing market share and eroding margins," explained Getinge CEO Mathias Perjos during the company's Q4 2024 earnings report, presented Jan. 28.

Issues with the company's production quality are not limited to the U.S. On March 1, 2024, TÜV SÜD, the European Union's body for certification services, temporarily suspended Getinge's CE mark certificate for the Cardiosave and required the company to take corrective actions.

The exit of Getinge from the cardiopulmonary bypass equipment (CBPE) sector will likely benefit dominant players such as LivaNova, which already had about 50.3% of the market share as of 2024, according to GlobalData, a data and analytics company. But GlobalData said Getinge only accounted for about 1.9% of the market share.

Despite FDA action sales have not slowed for ECMO or IABP

While Getinge said it plans top put more investment into its IABP and ECMO systems that do continue to do well in the market, these products are facing quality control issues with regulatory agencies.

The FDA worked with the U.S. Department of Justice to place Getinge manufacturing sites under consent decree in 2015 and added the IABP manufacturing site in 2022. These actions allow additional FDA oversight, an independent auditor, inspections, and updates on progress made toward addressing quality and safety concerns. As of May 2024, the FDA said the cardiopulmonary bypass and IABP facilities have not met the requirements to have the consent decree lifted.

The FDA sent a letter to providers on May 9, 2024, instructing them to transition from using the Getinge Cardiosave IABP and Cardiohelp ECMO systems to other vendors, unless they could not find an alternative. The FDA move was because of the ongoing quality-related deficiencies in Getinge's manufacturing.

At the time the letter was sent, Getinge said it had over 60% of the U.S. market share for these types of products. So despite the letter, Perjos said there was no impact on its sales in 2024. He said U.S. sales of these products made up about 7% of total Getinge revenues prior to the FDA letter and it was still at 7% at the end of 2024.

Perjos said disposables make up the bulk of the revenue for this market segment, so the vendor did not see a transition by hospitals to other competitor systems, which Getinge said was a little surprising.

"This has proved that the products are in demand and that we have high customer loyalty," Perjos said during the earnings call.

After the letter was released, Getinge stopped all promotional activities for Cardiohelp and Cardiosave in the U.S. until its quality improvements have been addressed and approved by the FDA. The company said it is making progress related to the FDA field actions for the Cardiosave IABP system. The company said the cost to fix the issues will be about $279 million, with work that will extend into 2026 and 2027.

Perjos also said Getinge has next-generation versions of the Cardiosave and Cardiohelp systems in the pipeline, so it is committed to continuing these product lines.

FDA compliance issues have been ongoing

The issues identified in 2015 had not been resolved by 2019, which led the FDA to sent a warning letter to Getinge. Inspections of its facilities between November 2021 and January 2022 found they were still not in compliance.

The company said its costs for the IABP improvement activities from 2018 to 2022 amounted to about $470 million.

Getinge planning to invest more in transplant and ECMO

Perjos said this will allow resources to be reallocation to more financially attractive areas, including extracorporeal life support (ECLS), or better known in the U.S. as extracorporeal membrane oxygenation (ECMO). The company is also putting more resources into transplant care.

As part of this move, Getinge acquired Paragonix Technologies Inc. in 2024, which saw impressive growth in the past quarter. Its KidneyVault portable renal perfusion system addresses the largest organ transplant market in terms of volume, and received FDA 510(k) clearance. The Paragonix product portfolio now encompasses all major organ categories, which includes about 50% off the market share for heart transplant.

Increasing competition in the U.S. ECMO market

Getinge has seen increased competition in the U.S. market that Perjos confirmed is making some headway. He said this confirms ECMO is an area of growth in the U.S. market

For example, Medtronic launched its Vitalflow ECMO system in September 2024.