Business concerns over costs and thin margins means it is no longer enough to just be a cardiologist

There is often a big separation between clinicians who do what is best for patients and the business management side of cardiology, but stresses on the U.S. healthcare system are now blurring that line. It is no longer enough to just be a cardiologist making clinical decisions, they also need to be aware of the costs, reimbursements, how billing works and the financial issues involved in healthcare.

That was one of the take home messages from Jerry Blackwell, MD, MBA, FACC, president and CEO of MedAxiom, the business consulting wing of the American College of Cardiology (ACC), who was a keynote speaker in the business of cardiology sessions at the ACC 2024 meeting. He highlighted the massive changes in the cardiology practice landscape over the past decade and said cardiologists need to expand their business acumen. He is still a practicing cardiologist at the Ballad Health System in Kingsport, Tennessee, and understands most doctors just want to care for patients. But many things have changed recently.

He spoke to Cardiovascular Business about the rising concern of ACC that cardiologists need to broaden their financial understanding of healthcare and see the big picture to help find solutions.

"One of the things that I really reinforced in my session is that all of healthcare, 100% of it, is paid from private households. So the notion that it doesn't matter is silly. All of our discussions are about how it's financed and we need to be very cognizant these days as clinicians—it is not just about the quality of the product. From my point of view, that has to become table stakes. But we need to know what is the impact and where does it fall inside of our health complex so that we can be responsible to the patient in front of us and to society at large. It is no longer an option to just say, 'I'm just a clinician,'" Blackwell explained.

He underscored the critical importance of understanding the business aspects of cardiovascular medicine, particularly against the backdrop of increasing financial pressures on physicians and hospitals. With cardiovascular diseases ranking as the leading cause of mortality for both men and women, cardiac care constitutes a significant share of the healthcare expenditures that make up between 15%-20% of U.S. gross domestic product (GDP). He said this means the intersection of medicine and business has never been more pronounced.

There were three main takeaways from Blackwell keynote address subhead below.

Cardiologists and trainees need more financial education

There were three main takeaways from Blackwell address. First, he emphasized that nonclinical competencies must now be ingrained within the fabric of medical education and training. Physicians and healthcare leaders alike must possess a comprehensive understanding of business principles to navigate the complex healthcare landscape effectively. He stressed the importance of education, advocating for the integration of business and management essentials into training programs for aspiring cardiologists and healthcare administrators.

"You don't have to go get an MBA to do this, but you do need to educate yourself and rub shoulders with somebody that knows a little bit about this. The education must be taken upstream to our younger fellows and trainees. In early career, it's not good enough to have old gray haired folks talking about this. This has got to be young people coming up," Blackwell explained.

On the billing side, he emphasized the need for cardiologists to be able to grasp the intricacies of the reimbursement process. Understanding the journey from coding and billing to claims processing and payment is essential for ensuring transparency and accountability in healthcare billing practices. He said that is needed to uphold standards of integrity and fiscal responsibility within the field of cardiology.

Healthcare is moving to a value-based payment system

The Centers for Medicare and Medicaid Services (CMS) plans to move from the current fee-for-service model to a value-based payment model by 2030. Blackwell said this will be a paradigm shift in how doctors and hospitals are paid.

This is similar to some of the current bundled payment models, which give a set amount on money to care a for a patient with a specific diagnosis or care episode. If a physician and hospital are efficient, they will make money. If they are inefficient and require a lot of testing, admission, a longer length of stay, or do not provide high quality care resulting in readmissions, they will not make as much and potentially lose money. He said this risk-based model for reimbursements is geared to making the providers more frugal and building in more efficiency.

This also means physicians will need to be much more aware of costs and what they get paid to better judge what the best tests, procedures and follow-up are needed for specific patients. Blackwell stressed that real transformation in healthcare occurs at the provider level and not at the insurer level.

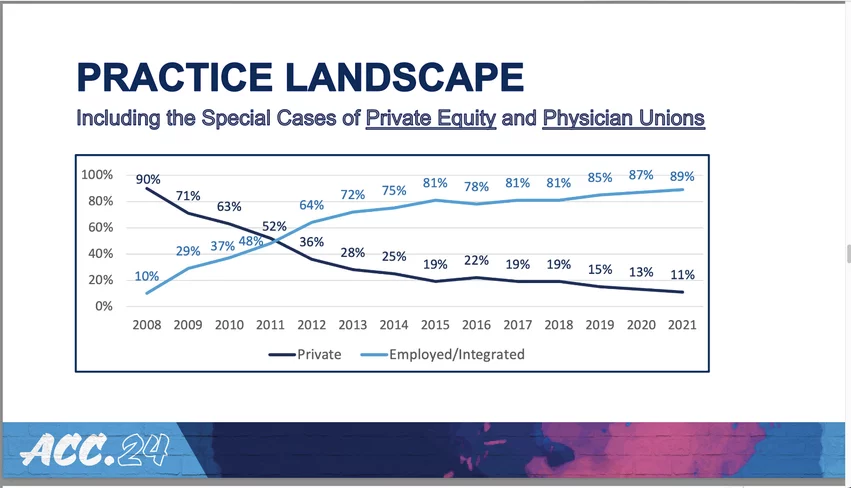

In the past decade, there has been a major shift in how cardiologists are employed. It changed from 90% in private practice in 2008 to rapidly being flipped completely opposite due to changing government policies and the economics involved in reimbursement. This was a key slide in the business of cardiology keynote by MedAxiom CEO Jerry Blackwell.

Cardiology ownership has rapidly moved away from private practice to hospital and private equity

In the past decade, the way cardiologists are employed has almost completely flipped. While a majority were once in private practice, most are now working for hospitals or private equity-backed management groups. Blackwell showed a graphic with a dramatic shift from 2008, when 90% of cardiologists were in private practice, to 2021, where only 11% were still in private practice. That slide was cited by several of the business session speakers as a wake-up call that the business of cardiology has experienced a paradigm shift at a scale that may have gone unnoticed by many.

These changes have largely been the product of policy modifications in how physicians are paid.

Where patients are getting care has also changed, with a rapid rise in office based labs (OBLs) and ambulatory surgical centers (ASCs). The emergence of private equity firms specializing in cardiology and buying up private practices has also risen over the past decade. Blackwell said about 5% of cardiologists are now working for private equity owned practices.

Private equity firms are investment vehicles generally limited to high net worth, sophisticated investors. They typically acquire an ownership stake in a private business, actively participate in managing the business, increase its value and often sell the business at a profit, he said.

The jury is still out on whether private equity is good or bad for cardiology, but it does lend concern about the loss of control over patient care to business decision-makers. The same is true at hospitals that have their own cardiologists. Blackwell pointed to these lack of control concerns giving rise to formation of physician unions. He said 5%-10% of U.S. physicians are now members of a union. This may foreshadow a future trend in medicine based on the massive loss of physician-owned practices.