Intravascular lithotripsy technology now a top priority for many healthcare companies

With the significant success of Shockwave Medical's intravascular lithotripsy (IVL) therapy to break up heavily calcified vessels without trauma, there are now several startups and large companies working to capture part of that growing IVL market share.

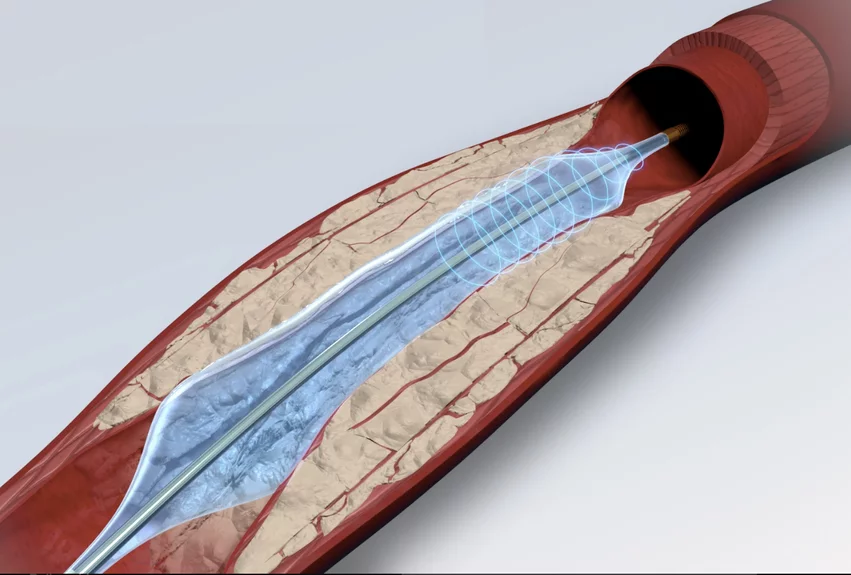

IVL has been a paradigm shift in interventional cardiology, helping care teams treat heavily calcified coronary and peripheral lesions to prep vessels prior to angioplasty or stenting. IVL does this without causing barotrauma, which was typical with the old standard of care using high-pressure balloon angioplasty. The technology borrowed the idea off using shockwave pulses of energy to break up calcium without blunt force from lithotripsy systems that have been used for years to break up kidney stones.

Shockwave Medical's IVL technology was the first to market, and the company has been leading the industry its IVL devices for several years now. The company gained a key U.S. Food and Drug Administration (FDA) approval in 2016 for treating peripheral arterial disease (PAD) and has since gained an additional coronary artery indication.

There were early adopters immediately after the first FDA clearance IVL in 2016 before reimbursements because of the advantages the technology offered with improved outcomes and improved safety. IVL for both PAD and the coronaries now has reimbursement and even received a bump in Medicare payment levels this year. This, combined with continued positive clinical studies, has helped with wider adoption of IVL.

IVL technology now under development

Success with new technologies brings competitors with new ideas for creating different approaches. There are now several startups and large companies working on their own IVL programs. These include systems using electrical mechanisms of action and others utilizing a laser modality. Companies working on IVL systems including Fastwave, AVS Pulse, Bolt Medical, Philips Healthcare, and Abbott.

FastWave Medical, a clinical-stage IVL developer, said this week it closed an oversubscribed $19 million funding round from earlier this year, which increased the total capital invested into the company to over $40 million.

This significant investment, led by Epic Venture Partners with participation from M&L Healthcare Investments and the company's existing investors, will fuel FastWave's development program and provide support for ongoing regulatory and clinical studies of its IVL platforms.

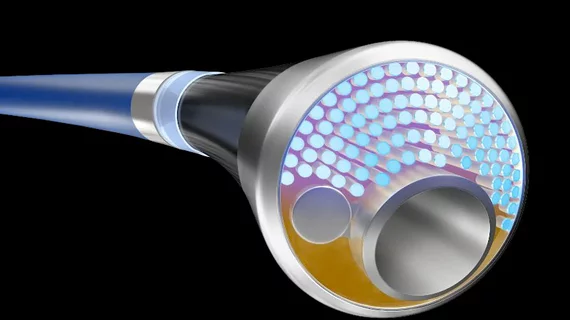

The company was formed in 2021 and has quickly moved in the development of what it says are a highly deliverable IVL catheters that offer durable, 360-degree sonic output. It has received six IVL patents in past three years.

"FastWave is moving quickly and decisively to become best-in-class in the IVL space. We are excited to support the FastWave team, as they continue to take down milestone after milestone," said Arthur Lee, MD, an interventional cardiologist and managing partner of Epic Venture Partners, in a statement.

Steven Kum, MD, a vascular surgeon and chief medical officer of M&L Healthcare Investments, holds similar optimism. "FastWave Medical has all the hallmarks of a company poised for significant growth and impact. Their commitment to evidence-based development aligns perfectly with our investment philosophy, and we're excited to be a part of a new era of IVL innovation that addresses the gaps left by current technologies," Kim said.

Boston-based Amplitude Vascular Systems (AVS) Pulse is also working to enter the U.S. market. The company's Pulse IVL System is currently enrolling 120 patients at 20 clinical sites in the POWER PAD 2 study, which is expected to be completed by mid-2025.

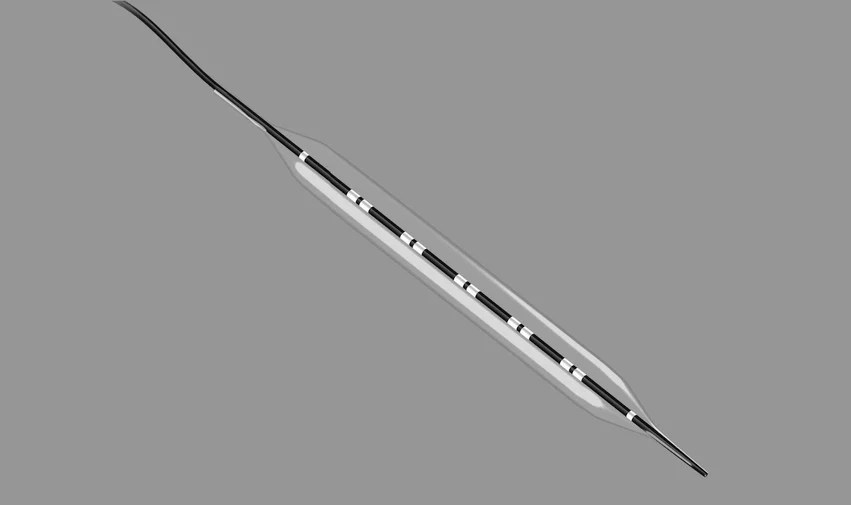

AVS uses a unique mechanism of action with high-frequency pulsatile pressure waves into a non-compliant balloon to fracture arterial calcium, rather than pulse emitters on the catheter. The company says its system offers improved deliverability with a lower profile catheter and an intuitive design.

Bolt Medical says its laser-based IVL platforms deliver consistent acoustic output with advantages over commercially available IVL platforms.

its system has improved deliverability with low crossing profiles, and offers robust pushability and trackability. The system also uses visible, directional emitters with on/off selectivity to direct energy to concentric, eccentric and nodular calcium lesions. Laser pulses create a pressure plume that fractures calcium. The plume also expands and collapses as a cavitation bubble, adding additional pressure on the calcium.

In November, Bolt Medical announced the completion and results of the RESTORE ATK and RESTORE BTK pivotal clinical trials investigating the company’s Bolt IVL bove the Knee (ATK) and Below the Knee (BTK) systems. Data from both studies were presented as late-breaking clinical trials at VIVA 2024 and will be used to support FDA and CE mark regulatory submissions.

Abbott Vascular, meanwhile, purchased Cardiovascular Systems Inc. (CSI) in early 2023 for $890 million. CSI is known for its FDA cleared orbital atherectomy systems, but has also developed an IVL system. The company completed feasibility testing in 2022 and said prior to the Abbott acquisition it planned to begin clinical testing in 2023. The technology is designed to allow physicians to cross and treat more challenging atherosclerotic lesions. CSI said commercialization of the IVL system will be complementary to its broader portfolio of vessel preparation technologies.

In November, Philips Healthcare announced enrollment of the first patient in the U.S. THOR IDE clinical trial, which will study a combined laser atherectomy and intravascular lithotripsy catheter developed by Philips to treat PAD. Procedures that previously required the use of two different devices could now be performed in a single procedure using a single device, simplifying care and potentially improving outcomes for patients who might otherwise face multiple complex interventions.