KLAS 2023 rankings for cardiovascular information systems and hemodynamic solutions

KLAS Research, a healthcare information technology market research firm, has released its 2023 Best in KLAS report, including sections on cardiovascular information systems (CVIS) and hemodynamic systems.

KLAS reports try to find the true story of what is happening with every vendor solution by interviewing clinicians who are the product end users. KLAS said the report is not a perfect sample size and does not include all vendors, but offers hospitals a much larger group of references than a traditional reference check of a couple customers from a vendor’s reference list. The research allows providers and payers to hear frank comments from install sites. The Best in KLAS report covers more than 1,000 health informatics solutions used across health systems.

Rankings of cardiology information systems

In the category of CVIS, clinicians ranked Merative (formerly IBM Watson Health) Merge Cardio Best in KLAS with an overall ranking of 82.7 out of a possible 100. This included high marks from end-users for culture, loyalty, operations, product, relationship and value. Merative also earned the only "A" grade by a CVIS vendor this year for its relationship with the hospitals.

The overall performance ranking scores of the CVIS vendors included in the report were:

• Merative Merge Cardio, 82.7

• Change Health Healthcare Cardiology Solutions, 80.7

• Siemens Healthineers syngo Dynamics, 78.9

• Fujifilm Synapse Cardiovascular, 78.8

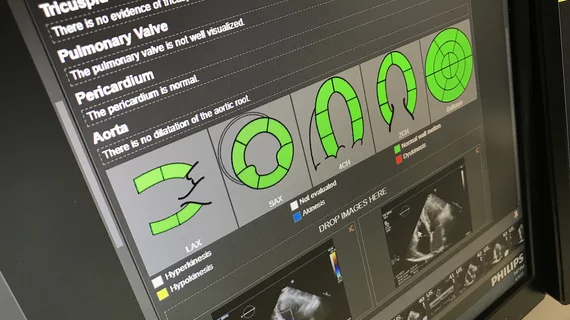

• Philips IntelliSpace Cardiovascular, 75.9

• GE Healthcare Centricity Cardiology Enterprise Solution, 68.3

Fujifilm Synapse Cardiovascular was the 2022 Best in KLAS CVIS vendor. This year, its score dropped 6%.

KLAS said GE dropped 20% in its ranking from its 2021 score. This included a grade of "D" for culture and loyalty and an "F" for value. GE Healthcare improved its score by 4% this year, but the KLAS grading system gave the vendor a grade of "F" for its culture and a "D" for value.

KLAS also included four other CVIS companies in the report, but these were not ranked with the other six above because due to limited data.

These companies and their overall performance score included:

• Infinitt Cardiology Suite, 86.7

• Epic Cupid, 83

• Philips Xcelera (Not the vendor's primary CVIS) 82.3

• Intelerad DigiView (Digisonics), 71.1

• Intelerad Apollo Advance (Lumedx), 57.8

KLAS asks users in the survey if they feel vendors charge for every little thing, if they keep promises and if they are using every part of their long-term plans. The vendors who score above 95% are listed for overall performance in these areas, but none of the vendors met the 95% approval ratings.

Another question asked if the end-user would buy the CVIS again, and only Change Healthcare was listed by 97% of respondents.

CVIS trends observed in 2022

In the KLAS Cardiology 2022 Opportunity for Market Disruption Decision Insights Report, there were key trends observed in hospital interviews conducted last year. These trends inluded:

1. Infinitt satisfies smaller organizations with strong implementations and support; Fujifilm improved significantly through innovation and relationships.

2. Change Healthcare and Merative remain market leaders in structured reporting adoption.

3. Satisfaction with GE HealthCare continues to drop due to diminishing relationships and development. Philips customers felt they were in limbo amid a transition to a full-web platform.

4. Epic rolled out new echo reports as Cupid customers continue to report unexpectedly high costs and build times.

5. Lack of cardiology knowledge from Intelerad (but based on limited data from end-users) created post-acquisition support difficulties. Siemens Healthineers performed consistently with little forward momentum.

6. In the hemodynamics market, Merative continues to lead, and Change Healthcare and Philips improved.

Rankings for cardiology hemodynamic systems

Hemodynamic systems are used to record patient vital signs and other physiological and procedural data during interventional procedures. Merative was ranked Best in KLAS and was the only vendor to get a "A" grades, which were for loyalty and relationship.

The rankings by end-users were:

• Merative (formerly IBM Watson Health) Merge Hemo, 85.7

• Change Healthcare Cardiology Hemo, 81.2

• Philips Xper Hemodynamics, 80.8

• GE Healthcare Mac-Lab, 77.3

Change Healthcare introduced a new hemodynamic system in 2022 to retire one that was a decade old. This appears to have changed user experiences, with the vendor rising 11% in its ranking from last year.

GE's Mac-Lab declined 8% from its ranking in 2022, when it was in the No. 1 spot. Philips rose 5% in its ranking.

Both Change Healthcare and Merative were said to be included in long-term plans at the hospitals where they were installed by 97% of end-user respondents.