Cardiovascular Market Report: Growth Dynamics & Program Finances

With physicians and administrators ever more focused on high-quality medicine and the financial bottom line, what trends and strategies are shaping the future of the cardiovascular service line? Let’s take a look at the future forecast through the expert eyes of Brian Contos, an executive director of The Advisory Board Company. Is your program poised to take advantage of changing market dynamics such as outpatient care, reimbursement and payment policies? And what about implantables, MACRA patient-focused care and interventional procedures like Protected PCI?

Over the last several years we’ve seen an evolution in cardiovascular services from a market dominated by inpatient procedures to one in which the growth of outpatient services is taking the lead. We’re still seeing growth in some of the higher-end acute care services, but that growth tends to be more in the niche services.

Much of the downward pressure on inpatient volumes comes from the shift to more outpatient care. The market is seeing 20 percent growth for outpatient EP procedures, vascular cath, as well as medical vascular services. On the other hand, the largest declines come from inpatient procedures and services such as cardiac cath, vascular interventions and even medical admissions.

Several factors come into play. First is regulatory oversight. There has been a tremendous amount of scrutiny surrounding whether or not a patient should be admitted as an inpatient vs. cared for in the outpatient setting, such as the Two-Midnight Rule. Second is scrutiny about appropriate use in interventional cardiology, including some EP implantables.

“Of particular note [in our market forecast numbers], cardiac cath services have begun to stabilize, and this is after several years of pretty predictable declines,” Contos points out. “Some is the natural evolution of the service line. Several years ago, everyone was chasing after peripheral vascular procedures, somewhat as a way to make up for some of the losses within interventional cardiology. Now that market has matured with volume growth much less pronounced.”

Significant growth is centered around niche services, namely transcatheter aortic valve replacement (TAVR). From 2012 through 2015, TAVR volume vaulted 32 percent.1 Percutaneous VAD implants have surged 162 percent from 2011 to 2015.1 Thoracic endovascular aortic aneurysm repair also increased by 36 percent over the same period, while transcatheter cardiac ablation grew 33 percent.1

But whether we’re talking about TAVR, TEVAR, VADs or Protected PCI, procedures cannot be looked at in isolation.

“A growing refrain we’ve heard from experienced programs is, it's “A Program, Not a Procedure” — and they’re right,” Contos notes. “For instance, to be successful in TAVR, you have to be successful in ‘structural heart,’ and provide a foundation for multidisciplinary, patient-centered, cross-continuum care for all your patients.”

Like TAVR, complex PCI is increasingly receiving this programmatic treatment for several reasons. Medicare inpatient PCI cases are getting more complex and thus, hospitals may benefit from the disease center concept, he says. There are two DRGs for DES. One of them for cases when there’s a major complication or comorbidity present and/or presence of four or more vessels or stents (MS-DRG 246). The other DES DRG (MS-DRG 247) is for cases without those higher acuity/higher cost factors. In 2009, 19 percent of drug-eluting stent cases showed up in the highest acuity DRG. Fast forward to 2015 with 28 percent of patients in that DRG—and it’s a very similar story for bare-metal stent cases. Some of this change in case mix resulted from outpatient shift, meaning the lowest acuity cases preferentially shifted outpatient leaving more acute patients inpatient. But the case mix shift also reflects a real increase in the complexity of PCI.

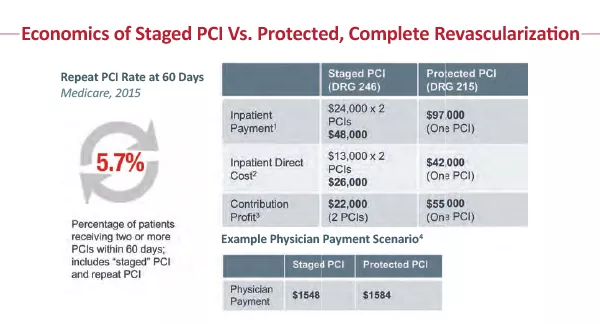

While clinical outcomes have shown a benefit for complete revascularization procedures in this complex patient population, economics may have been seen as a barrier. Looking at the economics, it becomes clear that if a facility stages two PCIs, they come away with about $22,000 in contribution profit. The Advisory Board also looked at what happens if you do complete revascularization and Protected PCI. These procedures map to MS–DRG 215. From a reimbursement standpoint, Protected PCI procedures bring the hospital closer to $55,000 in contribution profit. Appropriate treatment and identification of the patient appropriate for complex PCI requires that a hospital, led by the heart team, develops an algorithm for appropriate patient selection and standardized treatment of this very complex patient population. Many hospitals are implementing coordinators, just like with other programs (TAVR, MitraClip) to assist in consistently identifying and treating the complex PCI patient that could benefit from Protected PCI.

Payment strategies

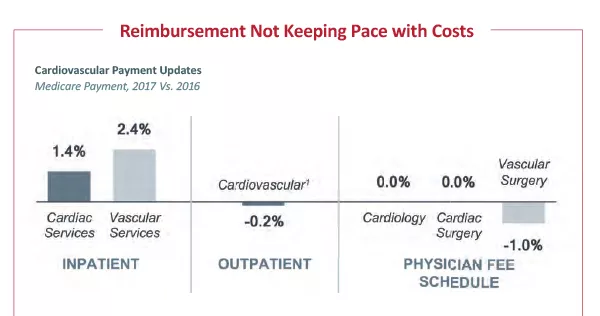

For years, hospitals have heard the refrain that payment is not keeping pace with cost growth. This is clear from the annual Medicare payment rulings. Inpatient and outpatient payment has changed little. From 2016 to 2017, inpatient payment increased 1.6 percent, and outpatient rates dropped by about half a percent. Physician payment adjustments haven’t improved either. For cardiology and cardiac surgery, it's a 0 percent change for 2017. And for vascular surgery, there’s a 1 percent reduction in allowed charges.

Aside from the numeric changes, there are several important updates that will impact payment going

forward, and the ability of providers to capture these dollars—starting with ICD-10. “This year marks the end of a year-long grace period where CMS basically accepted a pretty loose definition of which ICD-10s to assign to a particular patient,” Contos notes. “Now, we anticipate that there will be a need for greater specificity in coding.”

Also, 2017 ended a multi-year freeze for introducing or changing ICD-10 codes, and, in 2017, cardiovascular bears the brunt of these changes. There were roughly 3,500 cardiovascular code changes for 2017, although most of which he describes as cosmetic.

Every year, with the payment rulings, a new set of guidelines emerges around quality reporting. This is especially important as CMS has moved toward metrics that speak to cross-continuum care. For example, CMS has added 20-day episodic payment measures for AMI and heart failure, as well as 30-day mortality for CABG, to the Value-Based Purchasing Program for FY2021 and FY2022, respectively.

The most significant change in payment across the past year has been the start of Medicare Access and Chip Reauthorization Act (MACRA). “MACRA, among other things, finally did away with the sustainable growth rate (SGR) formula that's used to calculate physician payment.”

MACRA involves two tracks. The first is the merit-based incentive payment system, or MIPS, which consolidates current physician quality reporting programs and adjusts physician payments based on performance on select value-based measures. The second track is the advanced alternative payment model (APM) which includes a 5 percent increase in physician payment rate. But to get this, physicians have to have a significant portion of their revenue and contracts with downside risk. “As a result,” he notes, “initially, a relatively small proportion of physicians are going to qualify for the APM track.”

A significant implication of MACRA is that cardiovascular leaders have to be more strategic when they're aligning with physicians because hospitals are now on the hook for employed physicians' performance, Contos notes. “Unless you incentivize those physicians on performance in appropriate compensation models, employed physicians will actually be sheltered from the impact of MACRA.”

Greater scrutiny over episodic costs

In the last few years, episodic cost management has become a top-of-mind priority for CV providers, bolstered more recently by CMS’s announcement of Episodic Payment Models (EPMs) in December 2016. This rule called for mandatory bundles for CABG and AMI at hospitals in 98 randomly-selected metropolitan statistical areas, holding these hospitals accountable for cost and quality of care for 90 days postdischarge.

However, the future of the mandatory EPMs looks bleak. First, CMS delayed implementation from July 2017 to January 2018 in a March 2017 interim final rule. Then, as of the time of publishing, CMS has released a proposed rule to cancel mandatory bundles for cardiac patients. That said, CMS reiterated in the proposal that CMMI expects to develop new voluntary bundled payment models for CY 2018.

Despite softening rules at the federal payer level, we anticipate that episodic cost scrutiny will persist. As mentioned above, CMS continues to add episodic cost measures to pay-for-performance and pay-for-reporting programs (e.g., VBP, IQR). Furthermore, MACRA also increases the importance of managing cross-continuum costs as this is a focus of the measures in the cost/resource utilization category under MIPS. So programs should continue to build a strategy for managing costs across the continuum to prepare for these and other regulations that may come in the future.

Programs, partnering & priorities

Quality is clearly a priority as is a disease-centered approach, with the patient at the center. Cardiovascular service lines are looking to best practices pioneered in high-performing areas like transcatheter valves to apply to other populations, like complex PCI. Here’s the reality check. “If I am not the TAVR center, I'm not doing these procedures but I can still be part of an ecosystem of comprehensive care,” Contos says, “because I still manage the patient before he or she is referred to the TAVR center, and I'm also on the hook for their care downstream. So partnership is absolutely essential.”

Advisory Board data show roughly two-thirds of the hospitals did not offer TAVR in 2015 because they lacked the infrastructure, trained physicians or surgical volumes. But opportunities still exist for community hospitals managing TAVR patient care upstream and downstream to partner with comprehensive structural heart centers of excellence. “Partnership is key, both within and outside of your system, because it's all about ensuring that patients have access to high-value, appropriate structural heart care across the continuum,” he says.

He also points out that the infrastructure for a TAVR program can be leveraged for other high-end procedures such as complex PCI or your complete revascularization for higher-risk-indicated patients (CHIP) program. Four areas are key to building a solid program: a trained physician champion, hardwired identification, multidisciplinary care review and a nurse coordinator.

Identifying the right patients “is utterly essential,” Contos says. Both complex valve and complex PCI patients may have been deemed ineligible for treatment at other programs so it is key to identify them proactively and bring them to your program for evaluation and treatment.

Multidisciplinary care review includes the interventionalist and cardiac surgeon helps to identify the appropriate revascularization strategy and optimize use of hemodynamic support, while the nurse coordinator is the “glue that holds the program together,” he says.

Today's market forces compel us to think differently about how we organize and deliver care. That includes things like cross-continuum care coordination, longitudinal care quality, convenient patient access, multidisciplinary care, comprehensive service offerings and of course, patient loyalty. “These are compelling reasons to get up in the morning,” Contos says, “and they’re strategies to drive excellent cardiovascular care.”

1 The Advisory Board Company research and analysis

This story is abridged from a webinar presented by Brian Contos.

The full presentation is available at CardiovascularBusiness.com/growth_dynamics