Cardiovascular Subspecialty Clinics: How to Grow Big by Thinking Small

Could the shift from treating a large base of cardiovascular patients proactively to a significantly smaller number reactively be the key to actually growing your healthcare business?

A new Virtual Heart Failure Clinic at Atrium Health Sanger Heart & Vascular Institute is providing a revealing answer to that question and, in the process, highlighting the vast potential of cardiovascular subspecialty clinics to meet the complex demands of patients, along with the professional needs of overworked physicians. Sanger is reaping considerable rewards from an advanced system of remote monitoring and alerts for heart failure patients with implantable devices who are managed through its Virtual Heart Failure Clinic. That program, now being rolled out to 11 clinical sites in the Charlotte, NC area, has led to a major downsize—from roughly 250 to 15 high-risk patients a month.

A new Virtual Heart Failure Clinic at Atrium Health Sanger Heart & Vascular Institute is providing a revealing answer to that question and, in the process, highlighting the vast potential of cardiovascular subspecialty clinics to meet the complex demands of patients, along with the professional needs of overworked physicians. Sanger is reaping considerable rewards from an advanced system of remote monitoring and alerts for heart failure patients with implantable devices who are managed through its Virtual Heart Failure Clinic. That program, now being rolled out to 11 clinical sites in the Charlotte, NC area, has led to a major downsize—from roughly 250 to 15 high-risk patients a month.

“Once our system matures, the financial impact downstream of caring for a smaller but growing number of patients who may need transplants or VADS [ventricular assist devices] or device upgrades will be huge,” says Meghan Emig, MPAS, PA-C, Director of Advanced Practice for Sanger Heart & Vascular Institute. Already, the program has resulted in a nearly 60 percent reduction in time and 54 percent cutback in cost to treat congestive heart failure patients in our heart failure diagnostic program.

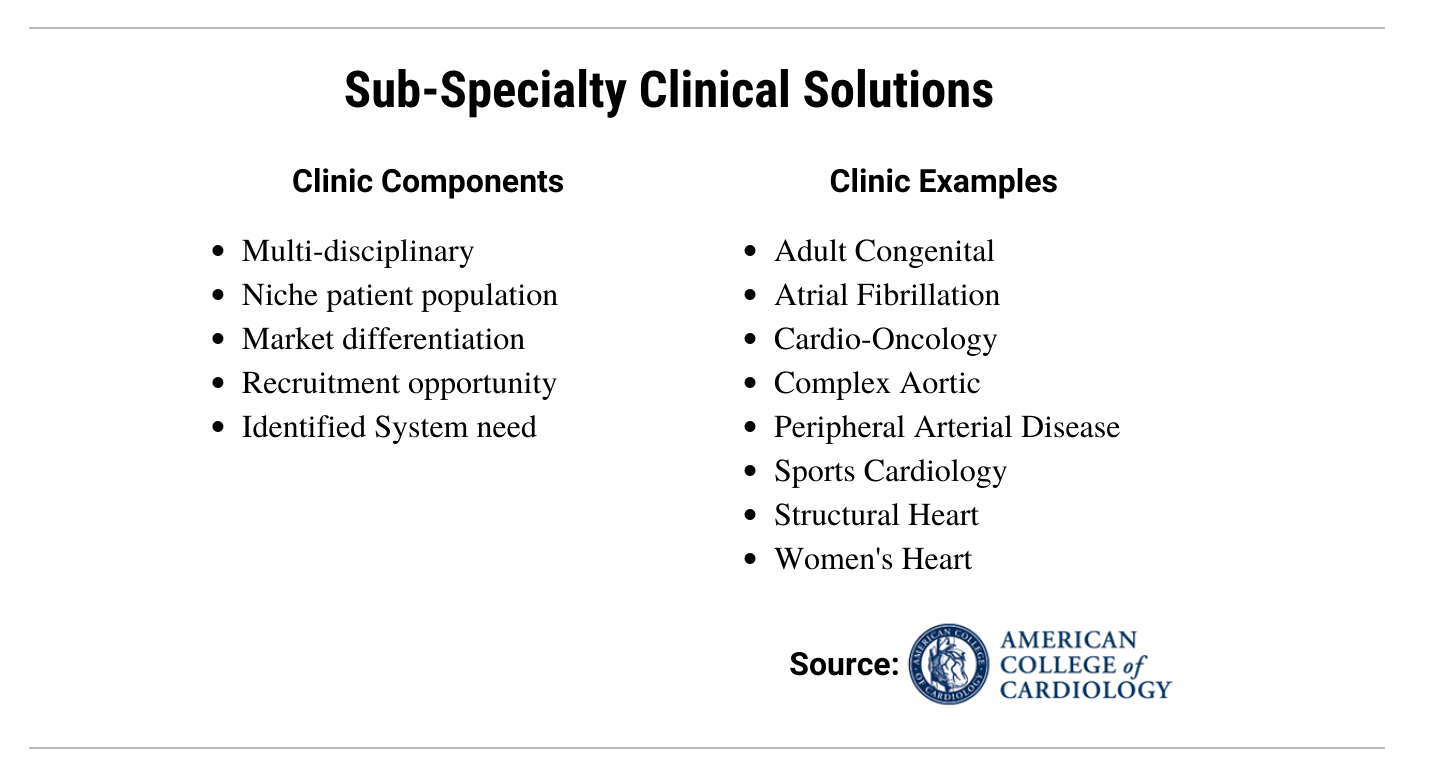

Subspecialty clinics have become more common in recent years as healthcare organizations have rethought how to deliver cost-effective care with better outcomes to their most complex, difficult-to-manage cardiovascular patients, such as heart failure, atrial fibrillation, and hypertension. They are now gaining in stature, number, and specialization, however, thanks to new technology and a more collaborative mindset among hospital specialists. Sometimes known as disease management clinics, they were featured at the recent 2021 American College of Cardiology (ACC) Cardiovascular Summit.

Subspecialty clinics have become more common in recent years as healthcare organizations have rethought how to deliver cost-effective care with better outcomes to their most complex, difficult-to-manage cardiovascular patients, such as heart failure, atrial fibrillation, and hypertension. They are now gaining in stature, number, and specialization, however, thanks to new technology and a more collaborative mindset among hospital specialists. Sometimes known as disease management clinics, they were featured at the recent 2021 American College of Cardiology (ACC) Cardiovascular Summit.

Above all, subspecialty clinics enable providers to match their resources and expertise to the right patient population. For patients, this dynamic results in greater satisfaction and the ability to access an array of services – including social work, nutrition, dietary and education – that might not be available through their traditional coronary provider. For physicians, the enhanced workflow and partnerships with advanced practice providers (APPs), nurses and others can help reduce the risk of burnout as they spend more time with patients and less time chained to a desk. And for healthcare organizations, subspecialty clinics provide an opportunity to cultivate new clinical niches—a such as cardio-oncology, hypertrophic cardiomyopathy (HCM), cardio-metabolic, and cardio-post COVID-19—that can not only turn into revenue generators, but differentiate them in the marketplace. From a financial perspective, they can also help to reduce patient readmissions and control healthcare costs—goals that weigh heavily on the minds of every provider nowadays.

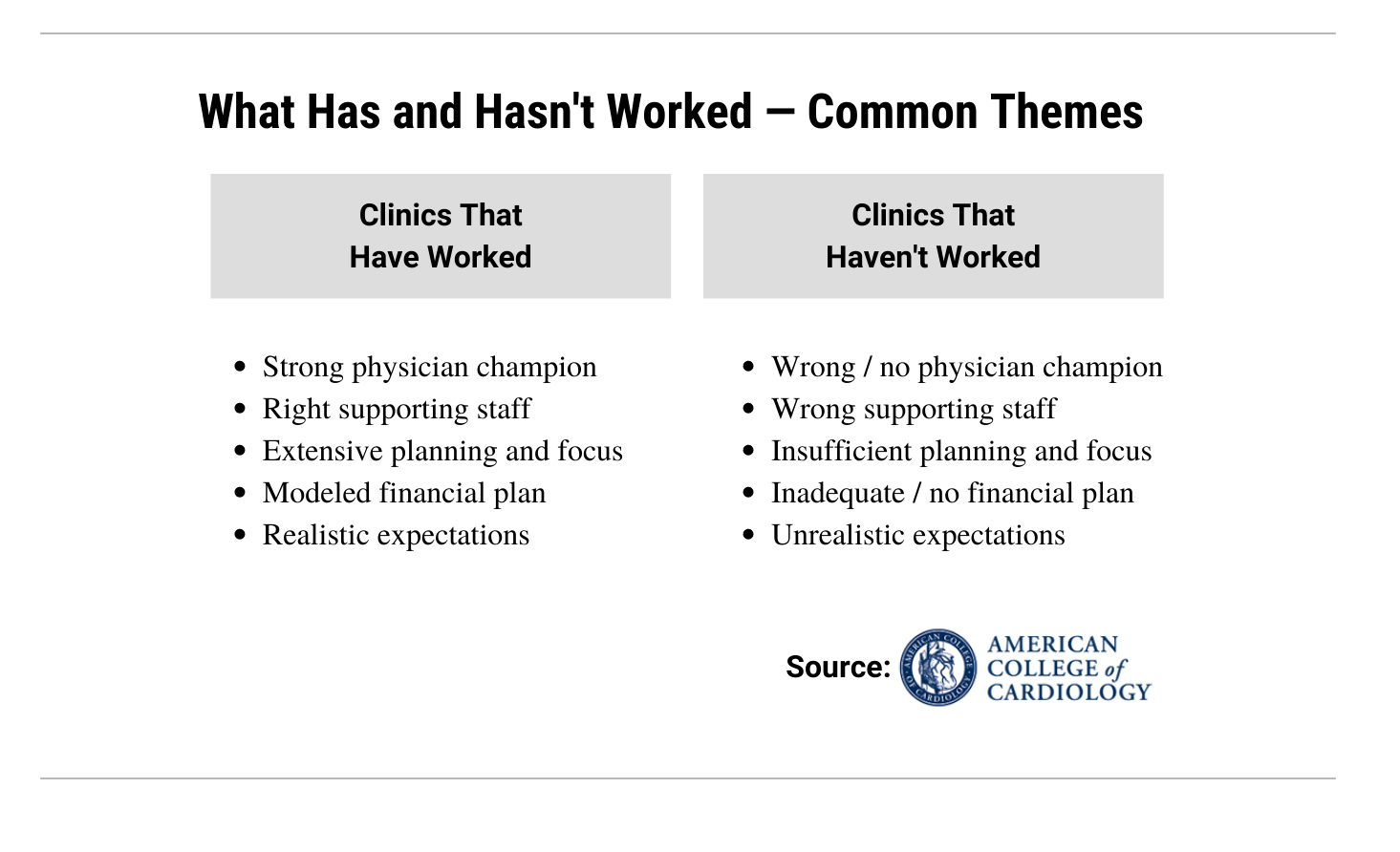

Notwithstanding the potential rewards, developing a profitable subspecialty clinic is anything but a slam-dunk. As Ginger Biesbrock, PA-C, MPH, MPAS, executive vice president of care transformation for MedAxiom, notes, success hinges on an exhaustive amount of upfront work to marshal the right people and resources, then ensure everyone is onboard. “I see a lot of heart failure clinics come and go because they didn’t make that level of commitment,” says Biesbrock, who explored clinic creation and maintenance at the ACC Cardiovascular Summit. “But if they carefully lay out who will be the patients and team members treating them, and what are the expected volumes and costs, then they stand an excellent chance of success.”

Notwithstanding the potential rewards, developing a profitable subspecialty clinic is anything but a slam-dunk. As Ginger Biesbrock, PA-C, MPH, MPAS, executive vice president of care transformation for MedAxiom, notes, success hinges on an exhaustive amount of upfront work to marshal the right people and resources, then ensure everyone is onboard. “I see a lot of heart failure clinics come and go because they didn’t make that level of commitment,” says Biesbrock, who explored clinic creation and maintenance at the ACC Cardiovascular Summit. “But if they carefully lay out who will be the patients and team members treating them, and what are the expected volumes and costs, then they stand an excellent chance of success.”

The Key to a Cardiac Clinic’s Success: Do Your Homework

Without a fine blueprint to steer subspecialty clinic development – what’s the objective and patient population, and who are the team members needed to make it happen --even the most well-intentioned project may never get off the ground.

In creating an atrial fibrillation clinic to serve Saint Luke’s Health System’s four hospitals in the Kansas City area, Saint Luke’s Mid-America Heart Institute knew precisely where it was headed. The objective? Reduce emergency department (ED) to hospital admissions by targeting newly diagnosed patients with AFib or those who were failing conventional therapy.

“We wanted to break the cycle that said every patient with AFib had to be admitted to the hospital,” says Sanjaya Gupta, MD, an electrophysiologist at Saint Luke’s Hospital in Kansas City who helped create the atrial fibrillation clinic. “A lot of existing research told us that the default process wasn’t necessary, so we implemented our own algorithm for rapid rate control and anticoagulation in the ED. And it showed that the majority of AFib patients could be stabilized pretty quickly and discharged without a hospital admission.”

“We wanted to break the cycle that said every patient with AFib had to be admitted to the hospital,” says Sanjaya Gupta, MD, an electrophysiologist at Saint Luke’s Hospital in Kansas City who helped create the atrial fibrillation clinic. “A lot of existing research told us that the default process wasn’t necessary, so we implemented our own algorithm for rapid rate control and anticoagulation in the ED. And it showed that the majority of AFib patients could be stabilized pretty quickly and discharged without a hospital admission.”

Indeed, hospital admissions of AFib patients have dropped from 75 to 35 percent under the new protocol. “We believe we’re freeing up beds for other patients who normally wouldn’t be available, while cutting back on the cost of care for each AFib patient,” says Gupta, whose specialty is cardiac electrophysiology. “Another important benefit is that we’re identifying through our program AFib patients earlier in the course of their disease so they can be treated more effectively, and with better outcomes.”

Beyond the use of algorithms, another critical part of the Saint Luke’s clinic is the requirement that all AFib patients be seen by an advanced practice provider for a follow-up visit within 48 hours of their release from the ED. As part of its upfront planning, Saint Luke’s looked at historical ED volumes to determine the median number of patients likely to be seen weekly in an atrial fibrillation clinic; it then determined the APP staffing needs that volume would require. “The biggest challenge for any new clinic is to be able to meet your treatment goals with the resources and expertise you already have available,” emphasizes Gupta.

Ginger Biesbrock, executive vice president of care transformation for MedAxiom, echoes that thought. “Right upfront you need a comprehensive clinical plan that identifies the patients you’re targeting and where these referrals are going to come from,” she explains. “If you don’t have a firm commitment by the organization to that care pathway, you’ll end up with very spotty utilization, and resources sitting idle.” Since many of those referrals will be from cardiologists or primary care physicians, it’s important to keep the lines of communication open so that these professionals are in the treatment loop and fully apprised of the panoply of specialized services available through the subspecialty clinic, Biesbrock adds. “The message shouldn’t be that we’re taking over your patients, but that we’re providing more comprehensive cardiovascular care to them and coordinating it with you,”

Equally important is determining the right players to render that care. The clinical plan should spell out the rolls, responsibilities and hours for subspecialty clinic personnel. These include nurses, APPs, physicians, dieticians, social workers, pharmacists, palliative care specialists, and others, depending on the type of patient. Having full backing of the healthcare organization’s leadership – and a designated physician “champion” – is also essential.

Equally important is determining the right players to render that care. The clinical plan should spell out the rolls, responsibilities and hours for subspecialty clinic personnel. These include nurses, APPs, physicians, dieticians, social workers, pharmacists, palliative care specialists, and others, depending on the type of patient. Having full backing of the healthcare organization’s leadership – and a designated physician “champion” – is also essential.

Also crucial to any subspecialty clinic looking to leave its mark is an upfront business plan. This means getting business analysts and the revenue cycle team actively involved in developing an operational model that reflects costs, staffing, patient volume, and services that will be reimbursable, such as transitional care management and remote monitoring. It’s a good idea, too, according to Biesbrock, to have a coding analyst at the table early on to advise how simple tweaks to the business plan might make the clinic eligible for greater reimbursement.

Subspecialty Cardiac Clinics that Can Enhance Your Image….and Bottom Line

While heart failure currently holds sway within the realm of cardiovascular subspecialty clinics, new models are emerging as promising sources of business development for enterprising healthcare providers. Opportunities range from structural heart disease, cardio-obstetrics and cardio-metabolic to cardio-oncology, palliative care and women’s health. Some hospitals are even creating subspecialty clinics around the cardiac needs of so-called post-COVID-19 ‘long haulers.’

Sanger Heart & Vascular Institute, for its part, is in the early stages of creating a cardio-oncology clinic aimed at its base of 17,000 new cancer patients a year, around 20 percent of whom will need cardiovascular workups. As envisioned by Sanger, the clinic would provide these patients with ready access to cardiac MR and echocardiology, and would offer strong nurse navigator support.

MedAxiom, which works with healthcare providers to create new clinical care pathways, has noticed an increase in structural heart disease subspecialty clinics in response to the explosion of patients undergoing TAVR, mitral valve replacement, and left atrial appendage closure. Cardio-metabolic is another growth opportunity aimed at diabetic patients with other co-morbidities who can benefit from the services of a primary and secondary prevention clinic.

MedAxiom, which works with healthcare providers to create new clinical care pathways, has noticed an increase in structural heart disease subspecialty clinics in response to the explosion of patients undergoing TAVR, mitral valve replacement, and left atrial appendage closure. Cardio-metabolic is another growth opportunity aimed at diabetic patients with other co-morbidities who can benefit from the services of a primary and secondary prevention clinic.

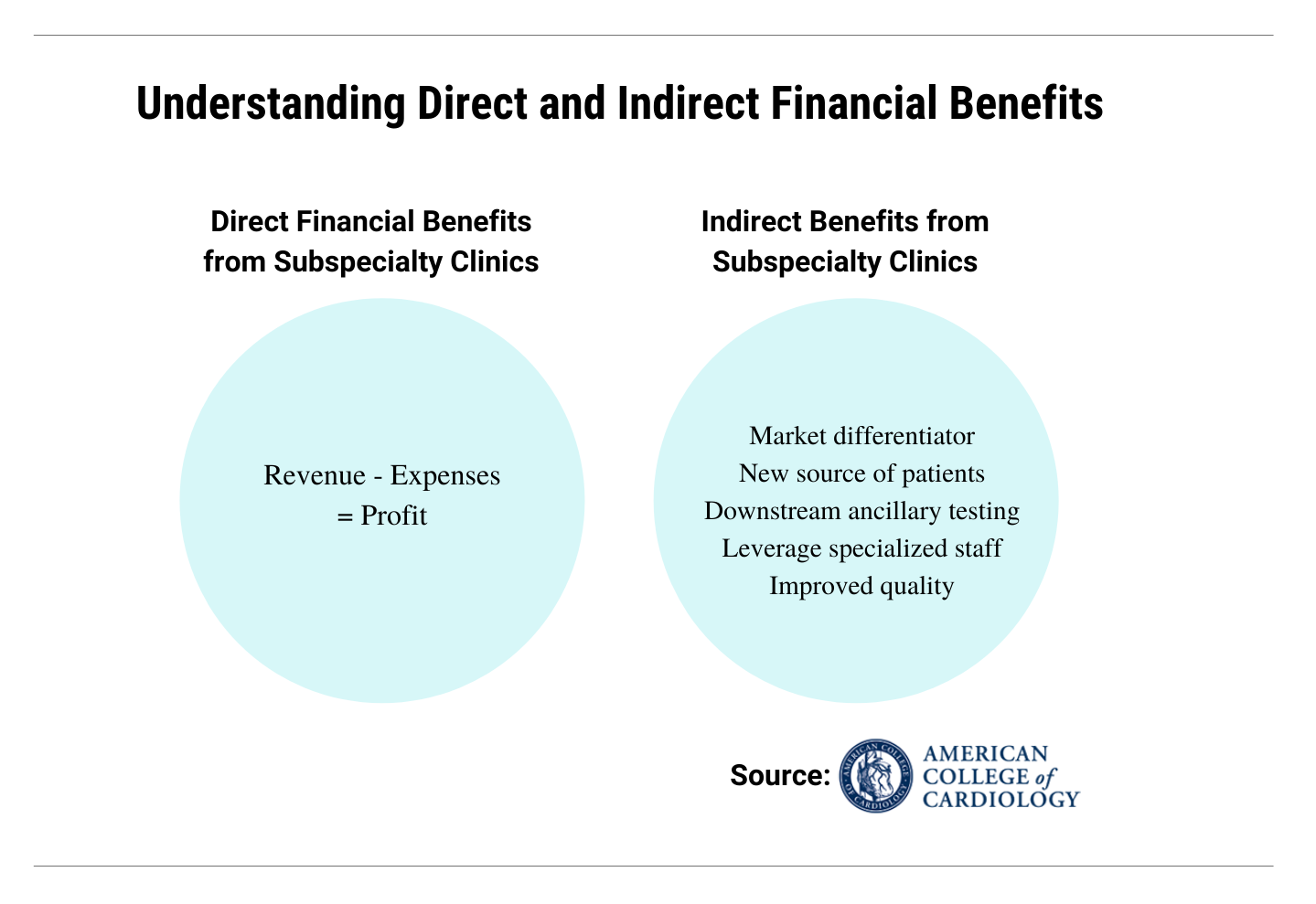

As for the bottom line, Biesbrock with MedAxiom separates disease management clinics into two categories. The first, led by heart failure, is geared to high-risk, resource intensive patients. This group has the potential to break even and perhaps make some money, though the more important goal is cost avoidance by keeping hospital readmissions and emergency room visits down. The second category consists of the newer brand of subspecialty clinics, like cardio-oncology, structural heart, and cardio-obstetrics. “These tend to be profit centers,” advises Biesbrock, “because they bring new patients into the system and allow for business growth by focusing your expertise in an area you can now actively market. They’re a source of differentiation.

Cardiovascular Business Longread is an editorial product focused on transforming cardiovascular care and outcomes through clinical, operational and financial excellence. Topics and sources are chosen by our editorial team.