HeartFlow raises $215M to keep up with growing demand

HeartFlow, the California-based healthcare technology company known for its FFR-CT technology, has announced the completion of a Series F funding round worth $215 million by its parent company, HeartFlow Holding.

The funding round was led by Bain Capital Life Sciences. A new investor, Janus Henderson Investors, also participated, as did Baillie Gifford, Capricorn Investment Group, Hayfin Capital Management, HealthCor, Martis Capital, USVP and Wellington Management.

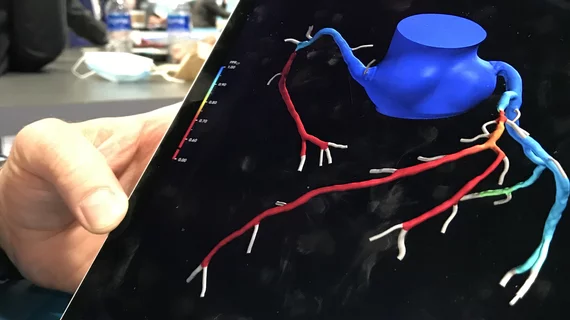

HeartFlow plans to use the new financing to help keep up with its rapid growth and expand sales of its artificial intelligence-powered solutions, including RoadMap Analysis and Plaque Analysis, which were both cleared by the U.S. Food and Drug Administration in October 2022.

“The oversubscription of our Series F funding round, particularly in the current market backdrop, is a strong validation of our technology, our team and the opportunity in front of us,” HeartFlow CEO John Farquhar said in a prepared statement. “We appreciate the support of our investors, both existing and new, who share HeartFlow's vision to build a new standard of care for people at risk of heart disease.”

“HeartFlow is a leader in precision heart care and its AI-enabled products promise to help physicians more effectively diagnose and treat heart disease, which continues to be the leading cause of death in the U.S.,” added Nicholas Downing, MD, a managing director at Bain Capital Life Sciences, in the same statement. “We look forward to supporting the company’s commitment to improving cardiovascular care for patients as it heads into this exciting next chapter of growth.”

HeartFlow’s growth reached new heights after its FFR-CT technology was included in the 2021 American College of Cardiology/American Heart Association chest pain guidelines. Watch this video from ACC.22 for additional context.