Edwards Lifesciences sells critical care business to BD for $4.2B—remains ‘laser focused’ on structural heart disease

Edwards Lifesciences has agreed to sell its critical care portfolio for $4.2 billion in cash to BD (Becton, Dickinson and Company), a New Jersey-based healthcare technology company. This move represents a pivot of sorts for Edwards; instead of pursuing a spin-off of its critical care business as originally planned, the company is now doubling down on its commitment to develop new structural heart technologies and expand its offerings in such areas as transcatheter aortic valve replacement (TAVR) and tricuspid valve replacement.

“Edwards’ underlying rationale for separating critical care remains the same: we are laser focused on pursuing a strategy centered on structural heart disease,” Bernard Zovighian, CEO of Edwards Lifesciences, said in a statement. “Our goal is to serve large unmet patient needs with our differentiated innovations while extending our global leadership, delivering sustainable growth and increasing shareholder value. Critical care has made significant contributions to our company and has a long history of pioneering innovation. We believe this transaction will strengthen Edwards, critical care and BD, paving the way for both companies to deliver even greater value to patients.”

“The transaction is expected to be immediately accretive to all key financial measures with a strong return profile, which underscores our continued commitment to generate sustained shareholder value,” Tom Polen, BD’s chairman, CEO and president, said in a separate statement.

The Edwards critical care portfolio includes its well-known Swan Ganz pulmonary artery catheters as well as other devices such as minimally invasive sensors and noninvasive cuffs. The division generated more than $900 in revenue in 2023 alone.

The two parties expect to finalize this transaction by the end of 2024. Katie Szyman, the current corporate vice president of critical care for Edwards, will then be put in charge of BD’s critical care business.

Edwards Lifesciences enjoying structural heart success in 2024

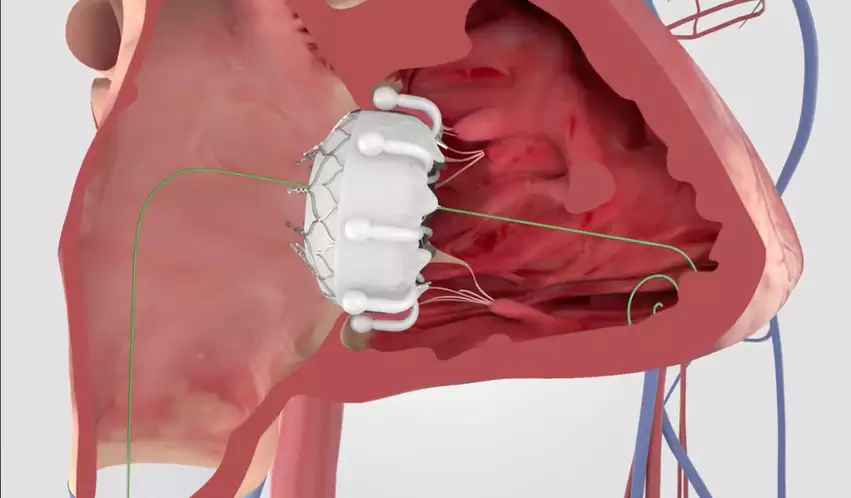

It may just be the beginning of June, but 2024 has already been a busy year for the structural heart specialists at Edwards. In February, for example, the company made history when its Evoque transcatheter tricuspid valve replacement (TTVR) system became the first TTVR device to gain U.S. Food and Drug Administration approval.

In addition, two recent studies published in JACC: Cardiovascular Interventions and EuroIntervention found that the company’s Sapien 3 Ultra Resilia TAVR device was associated with multiple benefits compared to its predecessors.