Cardiology Funding Roundup: Cardurion, Kestra, TRiCares all secure key investments

Businesses in the cardiovascular health space have busy in recent weeks, announcing one big financing round after another. Magenta Medical just raised $105 million to help secure U.S. Food and Drug Administration (FDA) approval for its new heart pump, for example, while Adona Medical brought in $33.5 million to go toward product development and getting its new technology in the hands of physicians.

These are some other big-dollar funding stories from the past several days:

Cardurion Pharmaceuticals raises $260M to help push new therapies forward

Cardurion Pharmaceuticals, a Massachusetts-based biotech company, closed a Series B financing round worth $260 million. Ascenta Capital led the round, with additional investments coming from NEA, GV, Fidelity Management & Research Company, Millennium Management, Farallon Capital Management, Invus, Blue Owl Healthcare Opportunities, Delos Capital, Digitalis Ventures, Bain Capital Life Sciences and Bain Capital Private Equity.

The new funds are expected to help support clinical trials focused on two drug candidates, a first-in-class phosphodiesterase-9 (PDE9) inhibitor for heart failure and a calcium/calmodulin-dependent protein kinase II (CaMKII) inhibitor that could potentially treat catecholaminergic polymorphic ventricular tachycardia and other cardiovascular conditions. Cardurion also plans to put some money toward pursuing new indications for some of its existing drug candidates.

“Cardiovascular disease remains the leading cause of death in the world, and we are pursuing new therapeutic targets to address unmet needs for patients with these diseases,” Peter Lawrence, Cardurion’s CEO, said in a statement. “Our experienced team at Cardurion has shown the ability to translate emerging science in cardiovascular signaling pathways into groundbreaking therapeutics with our PDE9 and CaMKII inhibitor programs, and we have now moved both programs into later-stage clinical studies where we can further evaluate efficacy in patients.”

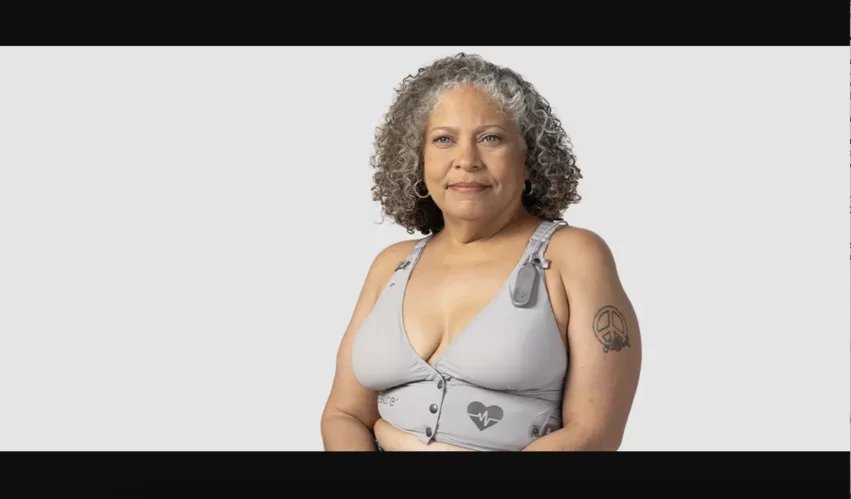

Kestra Medical Technologies raises $196M to support its wearable devices

Kestra Medical Technologies, a Washington-based healthcare technology company, raised a total of $196 million from several investors. Andera Partners, Ally Bridge Group, Longitude Capital and Omega Funds all led the way, followed by additional investments from Bain Capital, Endeavour Vision and others.

Kestra plans to use the fresh financing to expand its commercial enterprise and reach as many patients as possible with its wearable cardioverter defibrillator (WCD), the ASSURE system. In addition to the ASSURE WCD, Kestra also makes a wearable ECG for patients, a patient-facing smartphone application.

“This oversubscribed financing is validation of the excitement and confidence that new and existing investors have for Kestra and our ASSURE cardiac recovery system which has been prescribed to well over 10,000 patients to date,” Brian Webster, president & CEO of Kestra Medical Technologies, said in a statement. “With this funding, our team is ready to aggressively compete and accelerate our commercialization initiatives to transform the WCD market with our clinically proven system.”

TRiCares raises $50M to fund work on tricuspid heart valve replacement system

TRiCares, an international medical device company with offices in Paris and Munich, raised $50 million from a single investor in a new Series D financing round.

The company is currently working to gain key regulatory approvals in the United States and Europe for its Topaz transfemoral tricuspid heart valve replacement system. These funds are expected to go toward accomplishing those goals.

TRiCares has gained approval from the FDA to launch an early feasibility study (EFS) focused on patients treated with the Topaz system. The EFS will be overseen by Susheel Kodali, MD, with NewYork-Presbyterian/Columbia University Irving Medical Center and Gorav Ailawadi, MD, with the University of Michigan health System.

“I’m thrilled that we have secured this significant financing at such an important stage for the business,” Ahmed Elmouelhi, president and CEO of TRiCares, said in a statement. “This financing builds on previous investments from leading European life science venture capital firms, to whom we are grateful for their ongoing support and counsel.”